Lic IPO Review & details

Table of Contents

Introduction

LIC IPO Review – The full form of LIC IPO is life insurance corporation of the initial public offering of India, it is going to hit the main market in the upcoming week,

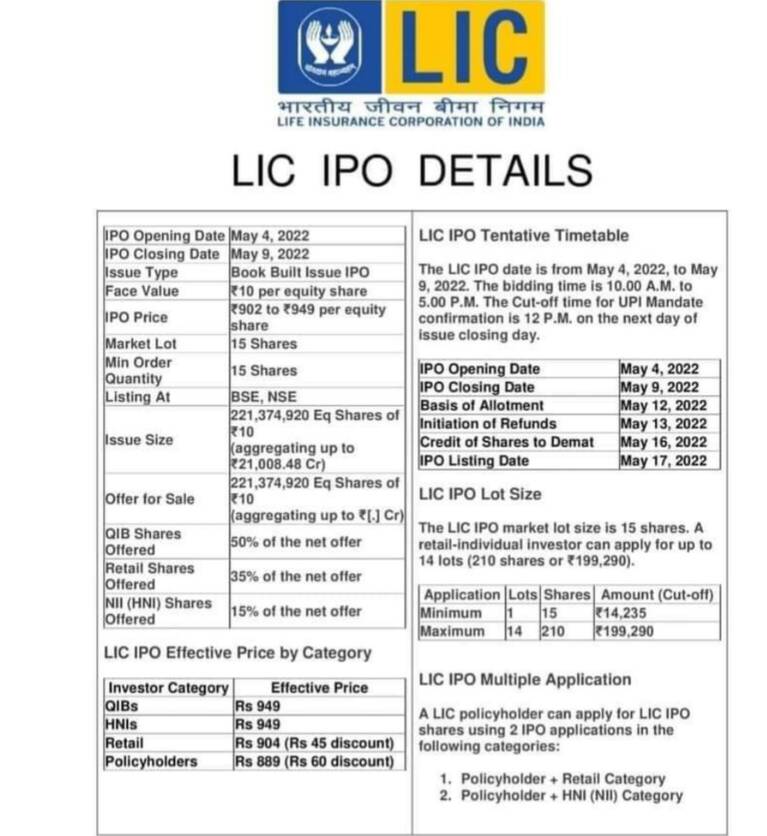

The subscription of LIC IPO will start on 4th May and it will go up to 9 to May, the public issue whose worth is 21,008 rupees crore is OFS in nature, the price of each share is going to be around 902 rupees to 949 rupees, in Grey market shares are available for just 92 rupees.

In this article we will discuss about LIC IPO Review and benefits of its and how to apply for this IPO, here is few most important thing related to LIC IPO Review which are –

LIC IPO Date 2022

LIC IPO Review – Leaks are there that, there would be an offer sale of 22.13 crores of share and it would be distributed for just 902 to 950 rupees, the initial public offering will start from 4th may 2022 and the issue will close by Monday on 9th May 2022

The bidders will receive their sales on 12th May and the bidders who failed will receive a refund of the money on the 12th, the same day of May 2022.

The issues will be simply transferred to their respective Demat account, after that on the 17th may the stock will enter the secondary market.

What is the LIC IPO price?

LIC IPO Review – Now, let us discuss the pricing of each share, the price of each share that would be issued from 4 May 2022will vary from ₹902.00 to ₹950, the goal is that they have to raise around 21,000 crores from this public issue, any bidder can easily apply a lot and the total LIC IPO will be compromised in total 15 shares.

Lic ipo good or bad

Everything has its good side and bad side, now investing in LIC fears is good or bad let us discuss this topic in detail-

- Investing in the shares can be a good opportunity to make money because you are getting the shares in a very low amount and the price of the shares can increase in upcoming days which would be very beneficial for the investors.

- According to the crsili’s report LIC offers you the highest equity return which is 82 percent.

Now let us discuss their demerits of investing in this-

- There will be a lot of competition and the company has lost its 5% market share.

- The only reason to invest should not be the company’s positive attention, extreme valuations can be also a risk and sometimes the reward is also not very favorable in its prices.

How to apply for lic IPO

Now, if you are willing to invest, below given are the steps you can follow to easily apply for LIC IPO-

- Send hi on the number (+919321261098) and click on IPO.

- Now click on “yes proceed” to confirm your number and if you are willing to change your current mobile number click on the “no change your number option”.

- Now you will receive an OTP in your mobile number enter that.

- There will be many options available but select the LIC IPO option and then click on the “apply now” option.

- Now select the number of Lots and the price amount of the bid.

- Make sure that every detail has been filled correctly and then click on the “proceed option”.

- Now enter your UPI ID and then click on the “Accept and proceed” option to complete the process of applying.

From Zerodha

Following, even are the steps you can easily follow to apply for LIC IPO from Zerodha–

- Open a Zerodha account.

- Sign up using your mobile number on its official website.

- Follow the simple instruction which will be displayed on your mobile screen and the account will be opened and you will be required to your bank account details and PAN number.

- You can also simply click here to open your online account in Zerodha.

From upstox

Now if you are willing to apply for LIC IPO from upstox, below given other steps you can follow to apply-

- Open up a Demat account is upstox.

- You can visit its official website to apply.

- Follow the instruction which will be displayed on your screen and you have to simply fill up your details there.

What is the process for applying for LIC IPO for the lic policyholder?

Now if you are a policyholder, in LIC and you are also willing to invest in their shares, following even other steps you can easily follow to apply for LIC IPO if you are also a policyholder-

- You are required to things if you are a policyholder to apply first is a pan card which should be linked to your account and a Demat account.

- Now you have to link your pan card with your LIC policy.

- You can click here to visit the LIC pan linking page.

- Now there you have to fill your all the required information like your gender, email ID, and your mobile number.

- Now enter the captcha code and the OTP and then click on the verify your OTP option.

ALSO READ –

How to apply for IPO in Zerodha App

Simply click SBI Card Review, Benefits, Eligibility

Conclusion | LIC IPO Review

LIC IPO Review – The full form of LIC IPO is “life insurance corporation of an initial public offering of India” and they are going to hit the main market by the next week and the opening of subscription will be from 4th May 2022 till 9th may 2022

the issue which is going to be publicly issued will be worth of 21,000 crores and the Government of India has fixed the amount of each share and the prices will vary from 902 rupees to 949 rupees, and in this article, we have discussed LIC IPO Review topic in briefly and we have also discussed that how can you easily apply for LIC IPO.

Frequently asked question | LIC IPO Review

What is the full form of LIC IPO?

The full form of LIC IPO is “life insurance corporation of an initial public offering of India”,

What will be the price of the shares?

According to the Government of India, the prices of the shares will vary from 902 rupees to 949 rupees and a total of 21,000 crores will be publicly issued.

What will be the price on the date of this year’s issue?

Leaks are there that, there would be an offer sale of 22.13 crores of shares and it would be distributed for just 902 to 950 rupees, the initial public offering will start from 4th may 2022 and the issue will close by Monday on 9th May 2022.

What is the process required to apply for LIC IPO, if you are a shareholder in LIC?

If you are a policyholder you are required two things the first is a PAN card and the second is your Demat account, and then you have to visit their official website and fill up the required information to apply for LIC IPO.